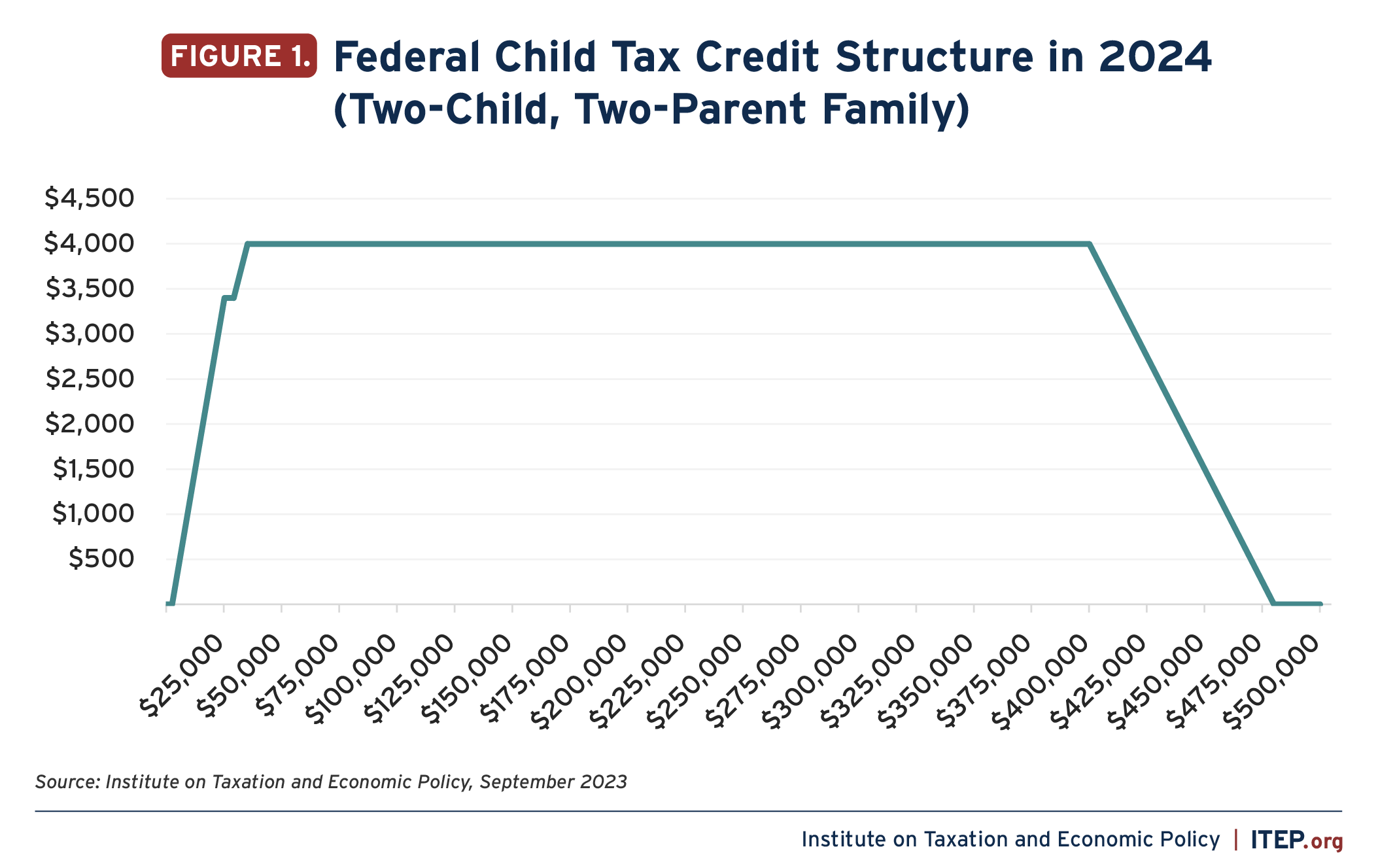

Child Tax Credit 2024 Phase Out Phase – If you paid for childcare, you may also qualify for the child and dependent care credit. Depending on your circumstances, you can declare 20% to 35% of your childcare expenses. The maximum you can . Child tax credits are likely to be expanded thanks to a $78 billion tax agreement between the Democrat-led Senate Finance Committee and the Republican-helmed House Ways and Means Committee. .

Child Tax Credit 2024 Phase Out Phase

Source : itep.org

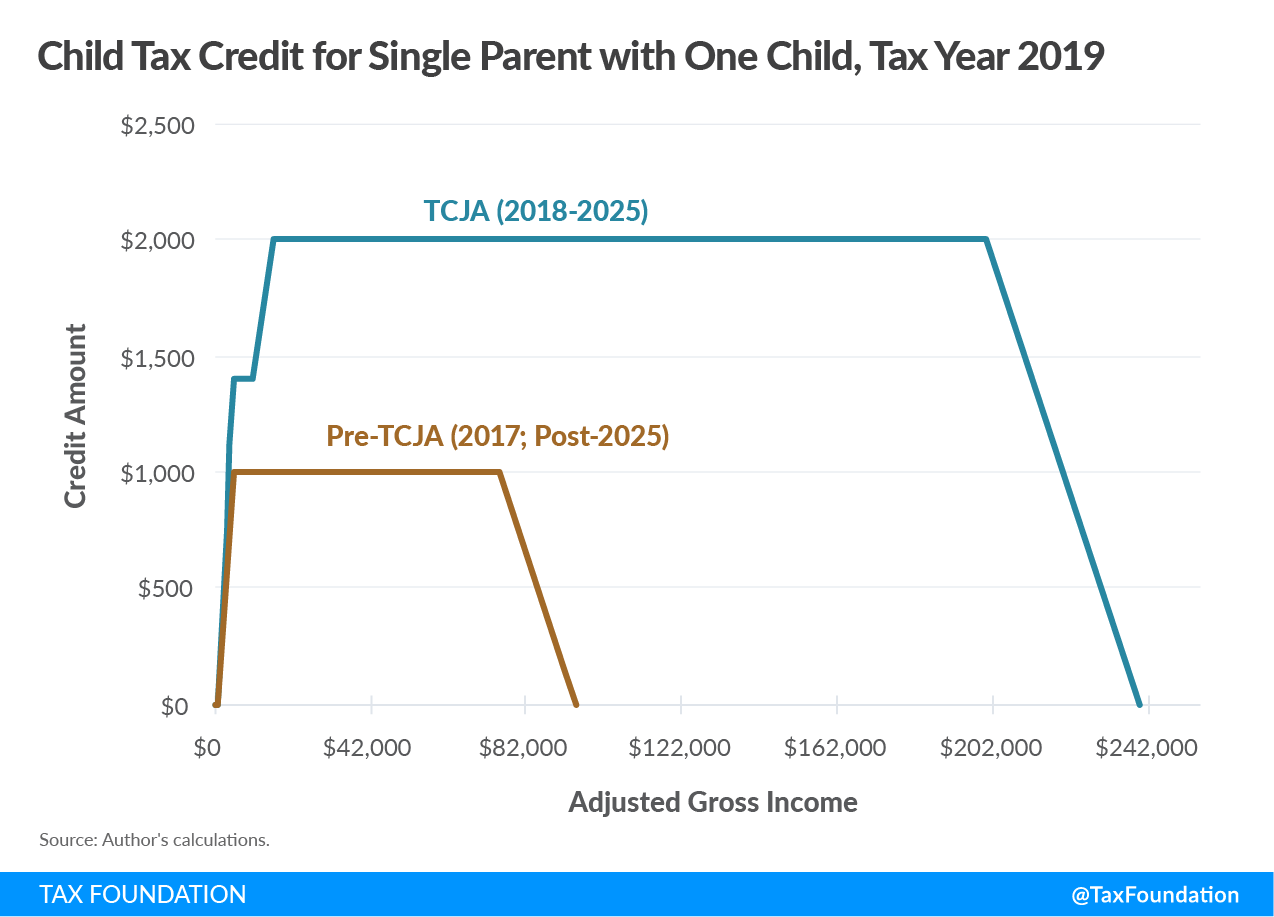

The American Families Plan: Too many tax credits for children

Source : www.brookings.edu

Child Tax Credit Definition | TaxEDU | Tax Foundation

Source : taxfoundation.org

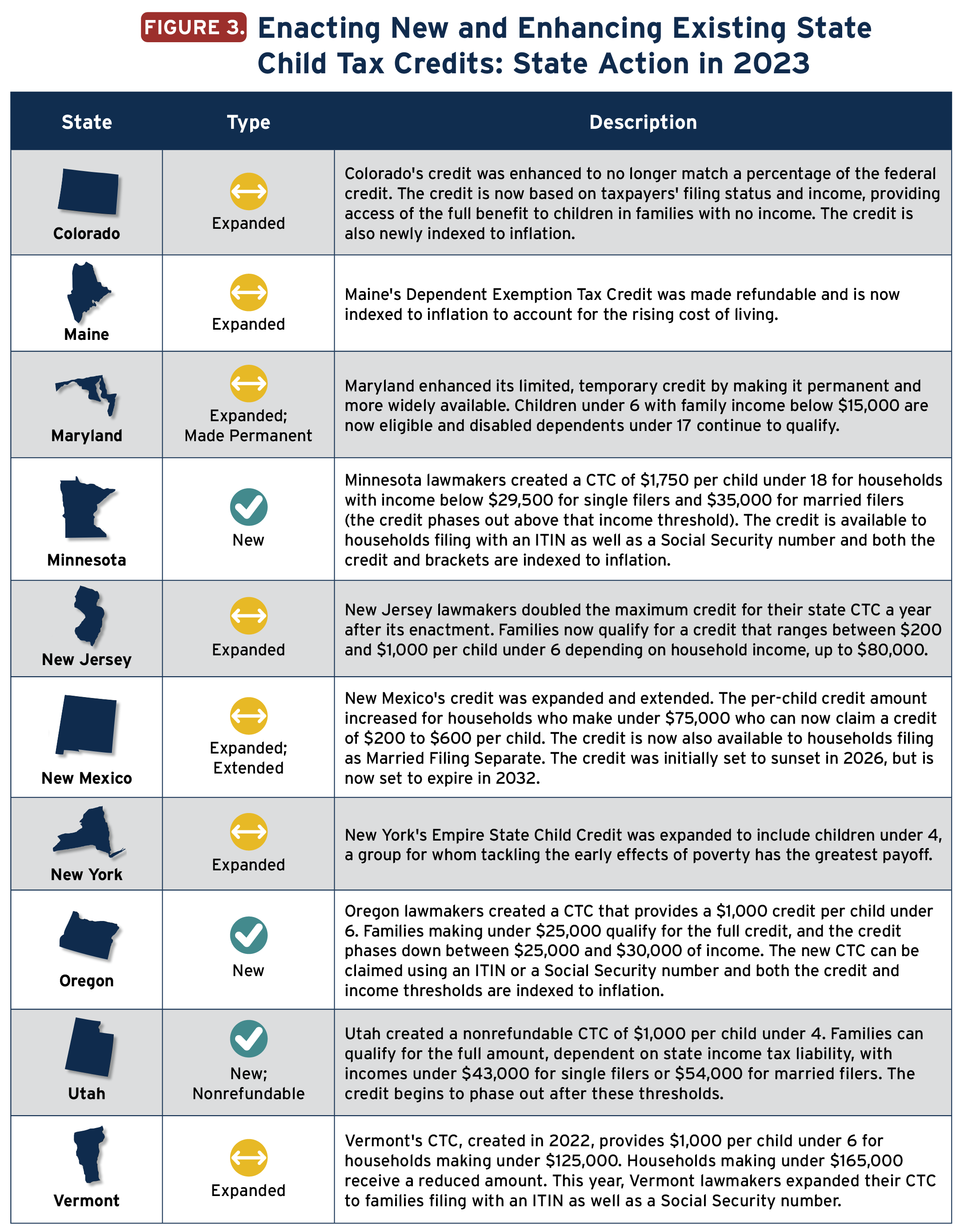

States are Boosting Economic Security with Child Tax Credits in

Source : itep.org

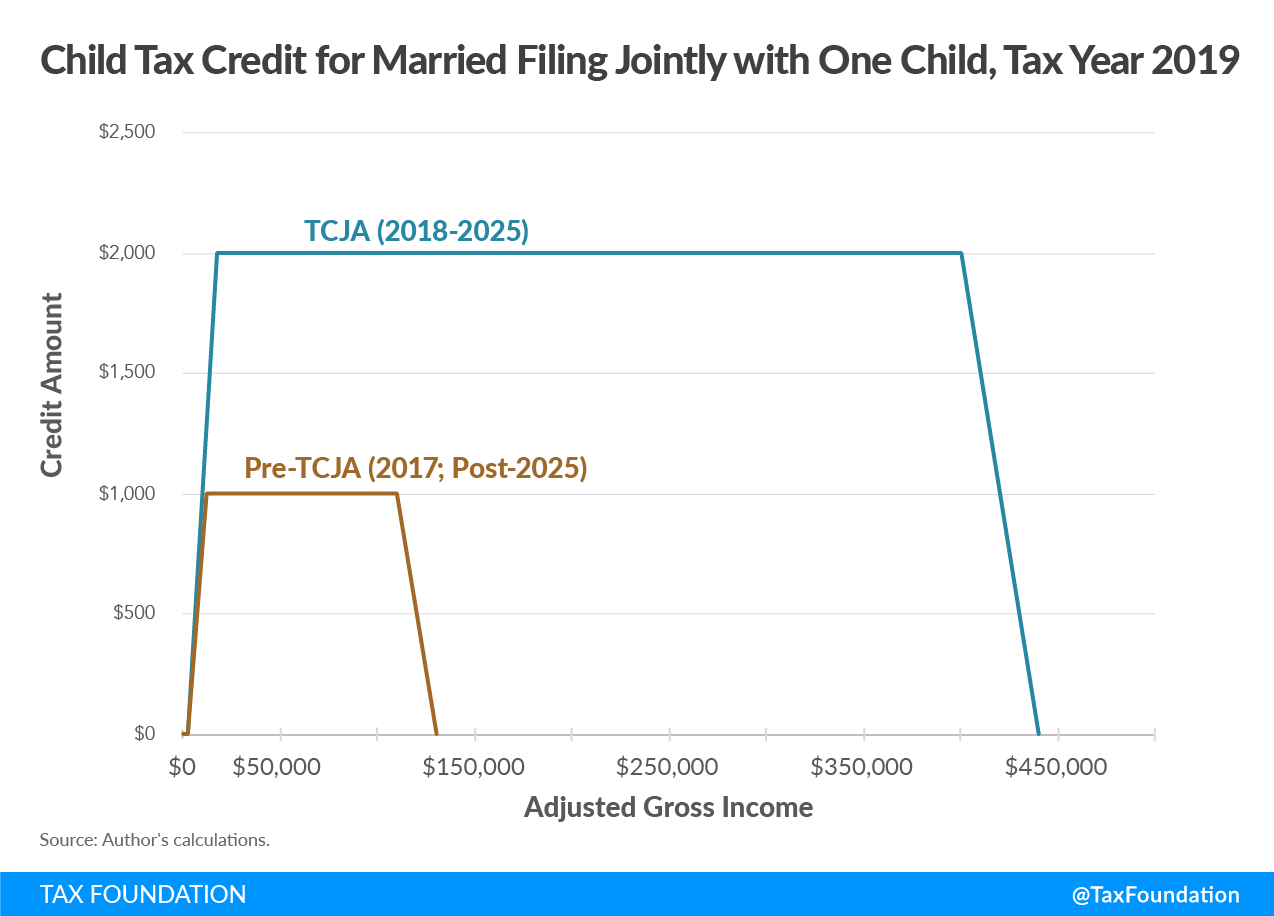

Child Tax Credit Definition | TaxEDU | Tax Foundation

Source : taxfoundation.org

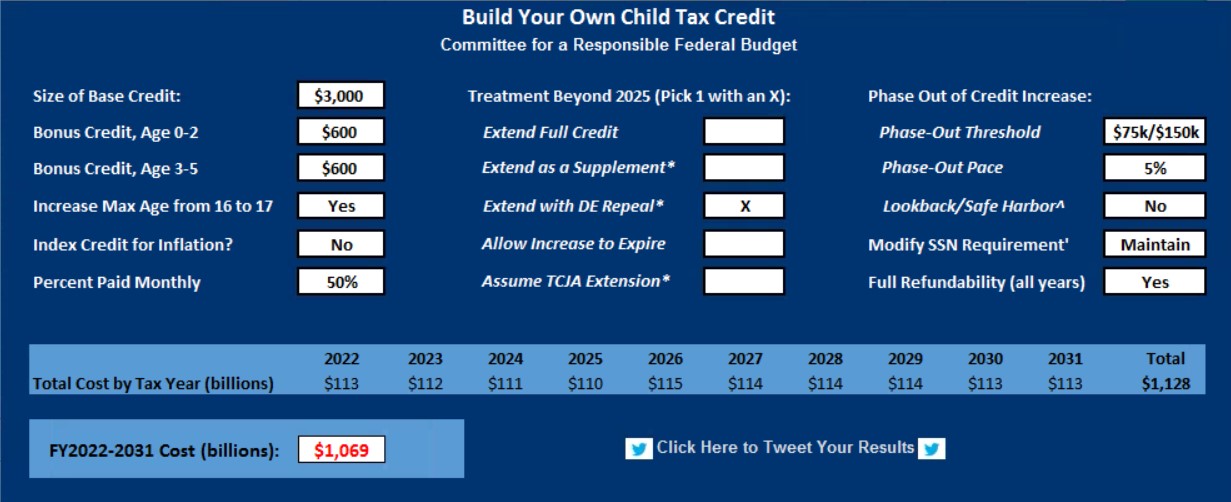

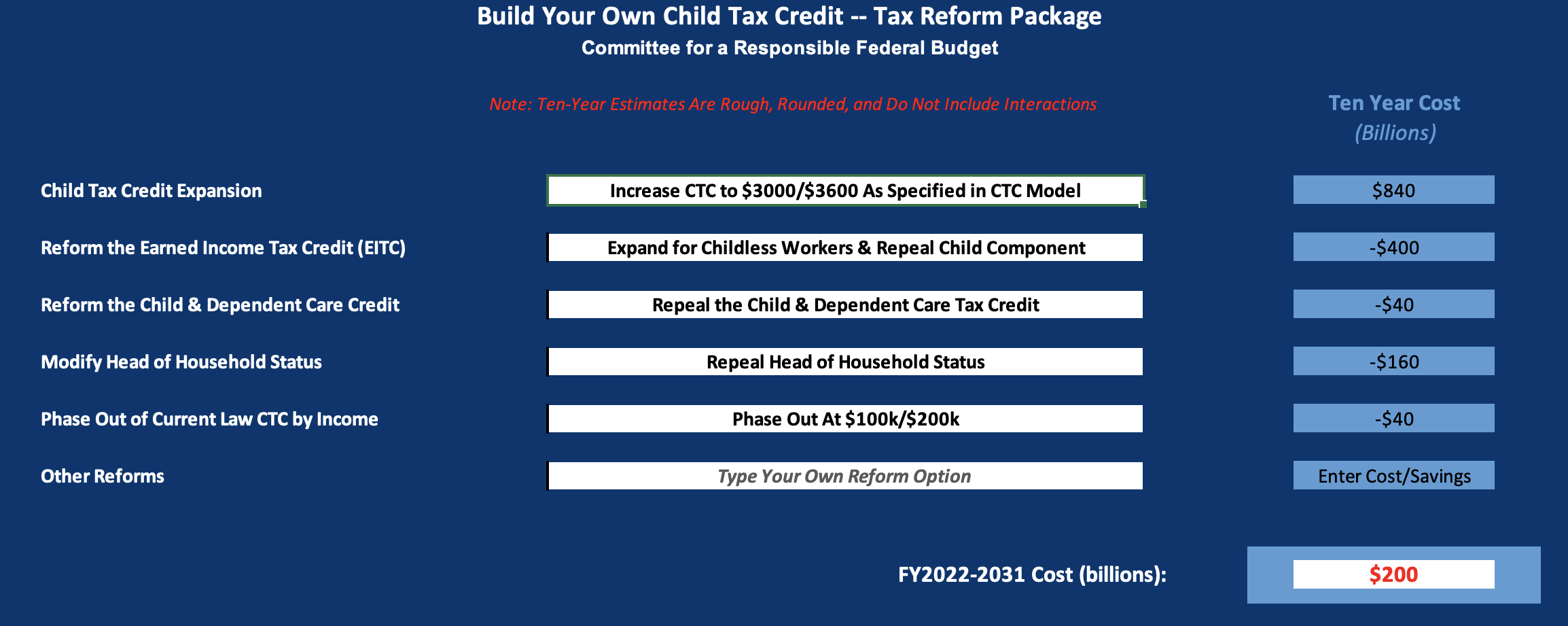

Build Your Own Child Tax Credit 2.0 | Committee for a Responsible

Source : www.crfb.org

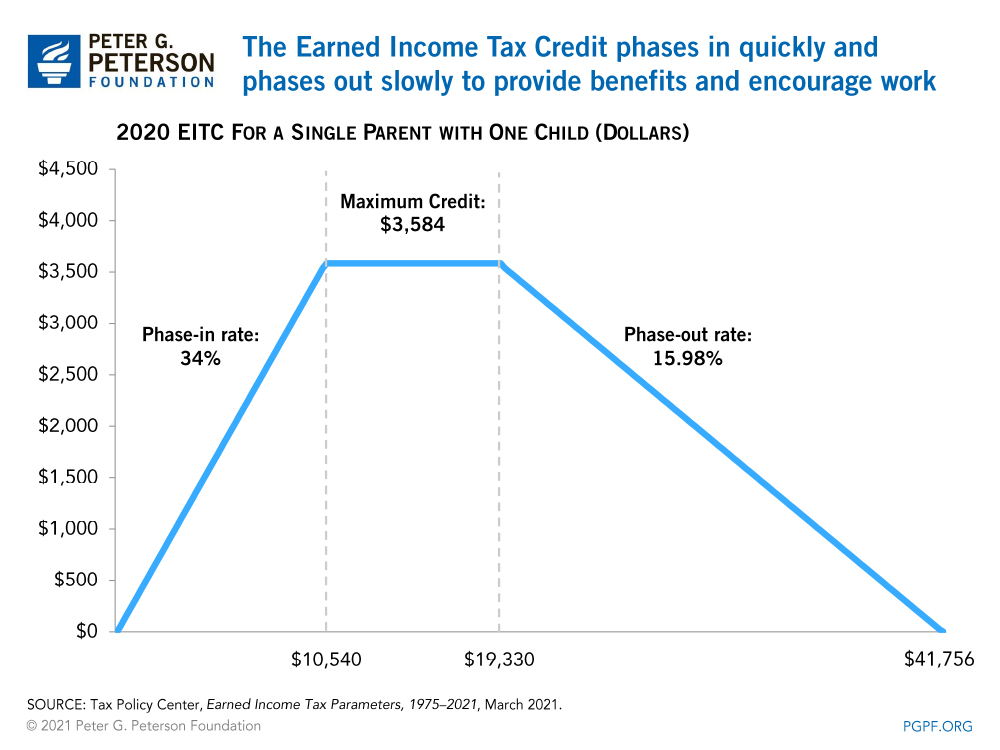

What Is the Earned Income Tax Credit?

Source : www.pgpf.org

2023 and 2024 Child Tax Credit: Top 7 Requirements TurboTax Tax

Source : turbotax.intuit.com

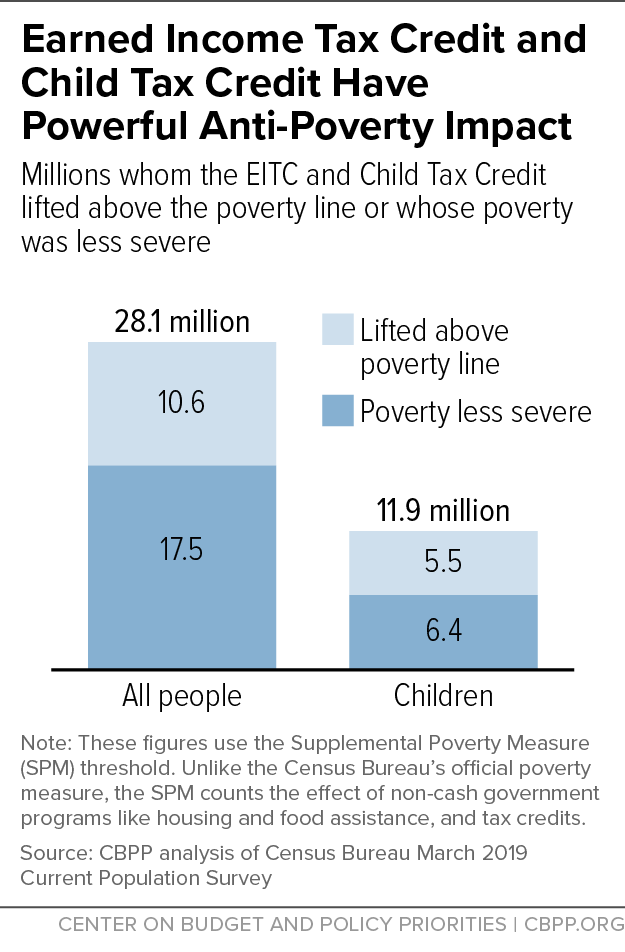

Policy Basics: The Earned Income Tax Credit | Center on Budget and

Source : www.cbpp.org

Build Your Own Child Tax Credit 2.0 | Committee for a Responsible

Source : www.crfb.org

Child Tax Credit 2024 Phase Out Phase States are Boosting Economic Security with Child Tax Credits in : While parents may be shelling out thousands of dollars a month for child care costs alone, they can offset these expenses with two tax credits this season. . “Federal student loan borrowers who were required to continue student loan payments starting in the fall of 2023 could qualify to deduct up to $2,500 of student loan interest per tax return per tax .